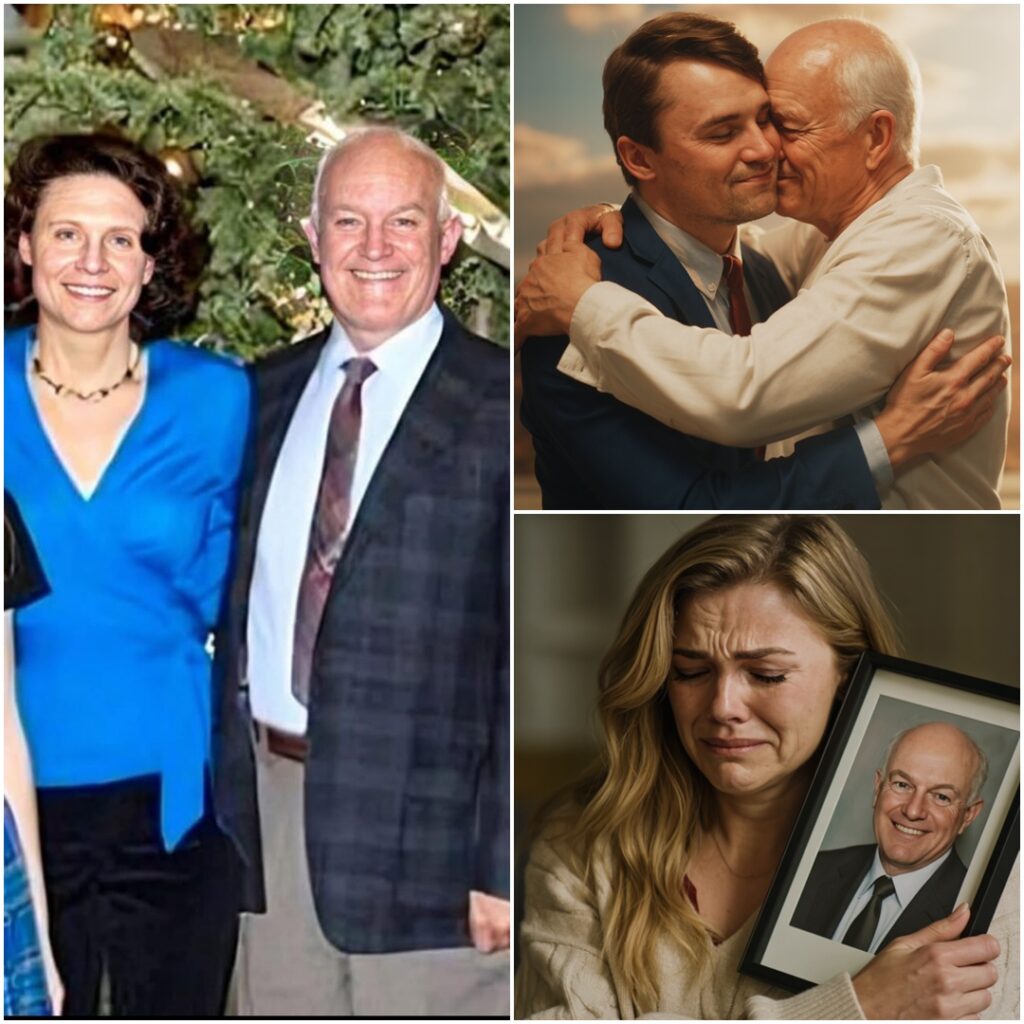

ss HOLLYWOOD SHOCKWAVE: Tragedy Strikes Again — Robert W. Kirk Passes Away After Years of Living in the Pain of Losing His Son Charlie!

Grief, it seems, has no expiration date. And for Robert W. Kirk, father of the late Charlie Kirk, it was a wound that never closed.

arrow_forward_ios

Read more

00:00

00:00

01:31

Just years after losing his beloved son in one of Hollywood’s most publicized tragedies, Robert has passed away — another heartbreaking chapter in a family story already steeped in pain and loss. Those close to the Kirks describe his final days as quiet and heavy, a man slowly fading under the weight of a sorrow too deep to bear.

A father who never healed

When Charlie Kirk died, the world mourned a rising star — but behind the flashing lights and front-page headlines was a father whose world collapsed. Robert was more than Charlie’s parent; he was his confidant, his mentor, his anchor. Friends say he never recovered from that loss, carrying the grief like a permanent shadow.

“He used to say that every sunrise felt dimmer without Charlie,” a close friend shared. “He kept his son’s photos everywhere — in his car, his office, even next to his bed. It was as if he couldn’t let go, even for a second.”

Over the years, Robert withdrew from public life. He stopped attending events, distanced himself from Hollywood circles, and spent more time in solitude. Despite his wealth and influence, those who knew him said he seemed like a man quietly counting the days.

A loss too heavy to survive

Family insiders revealed that Robert’s health had been declining for months. Doctors warned of complications linked to stress and depression, but those close to him knew it wasn’t just physical. His heart, they said, was broken long before his final day.

“He’d visit Charlie’s memorial almost every week,” one longtime friend recalled. “He’d sit there for hours, talking as if Charlie could still hear him. You could see the pain in his eyes — the kind of pain that never leaves.”

In the end, Robert passed away peacefully at home, surrounded by family members who had watched his strength fade year after year. His death, though not unexpected, has reignited public emotion across the entertainment world.

The Kirk family’s unbearable burden

For the Kirk family, this loss marks another cruel blow in a saga that has already broken so many hearts. First came Charlie’s sudden and tragic death — a moment that shook Hollywood to its core. His charm, talent, and rising fame made him a beloved figure whose absence left an unfillable void.

Now, with Robert’s passing, that legacy of sorrow deepens. “It’s as if the grief consumed him,” a family insider told The Chronicle. “He just couldn’t live in a world without his son.”

Friends describe Robert as a man of quiet strength who was deeply loyal to his family. In public, he was composed; in private, he was shattered. Even in his final months, those closest to him said he spoke more of Charlie than of himself. “He never said goodbye,” one confidant revealed. “He said, ‘I’ll see him soon.’”

A legacy of love and pain

Robert Kirk’s life was marked by success, discipline, and devotion. A respected businessman and philanthropist, he had built a reputation for leadership and generosity. But beneath the polished surface lay a heart scarred by unimaginable grief.

Those who attended his private memorial described it as both intimate and haunting — filled with tributes not just to the man he was, but to the love that defined him. A framed photo of Charlie stood beside Robert’s casket, surrounded by candles and handwritten letters from friends and fans.

As one mourner said softly during the ceremony: “He never stopped being a father.”

The echo of heartbreak

The Kirk family has requested privacy as they navigate yet another devastating loss. Their home, once filled with laughter, now stands as a quiet reminder of how fragile life can be — and how deeply love can wound.

Psychologists often describe prolonged grief as a condition that blurs the line between love and suffering. For Robert, that boundary disappeared long ago. His life became a quiet devotion to a son he could no longer hold, a son whose absence shaped every breath he took.

“Robert died of a broken heart,” a close family friend said. “There’s no other way to put it.”

A family marked by tragedy

In Hollywood, the name “Kirk” now carries a bittersweet legacy — one of ambition, love, and the unbearable cost of loss. Fans across the world have flooded social media with messages of condolence, sharing memories of both father and son.

“It feels like the end of an era,” one fan wrote. “They’re together again — but it’s just so tragic that grief had to take him too.”

For now, the story of the Kirk family stands as a haunting reminder that behind the glitz and glamour of fame are real people, fragile hearts, and wounds that fame can never heal.

Robert W. Kirk’s passing leaves behind a legacy not only of success, but of a father’s endless love — a love so strong, it refused to fade, even in death.